Frequently Asked Questions About Planned Giving

You don’t have to be wealthy to make a significant gift to the Green Party, and you can make a gift that costs nothing during your lifetime.

NOTE: The Green Party and its employees or representatives do not offer legal or financial advice. We strongly urge prospective donors to consult with your attorney, financial advisor, estate planning professional, accountant or other appropriate professional before making any material decisions based on information we provide. State laws govern wills, trusts, and charitable gifts made in a contractual agreement.

What happens if I die without a valid will?

Some 60% of Americans die without a valid will. If this happens to you, the state you live in will distribute your probate estate in accordance to a prescribed formula – possibly in ways that you would not choose. Any charitable donations you wanted to make will not happen.

Do I need an attorney to write a will?

Some states allow an individual to compose a will. If it is properly witnessed and signed, many Probate Courts will accept such a will.

However, a will is a very important legal document, and it is wise to employ the expertise of a qualified attorney, especially if you have multiple heirs and/or significant assets. A will is one of the least expensive legal documents you would pay for, but a well-written document could save your heirs much more in dollars and hassle.

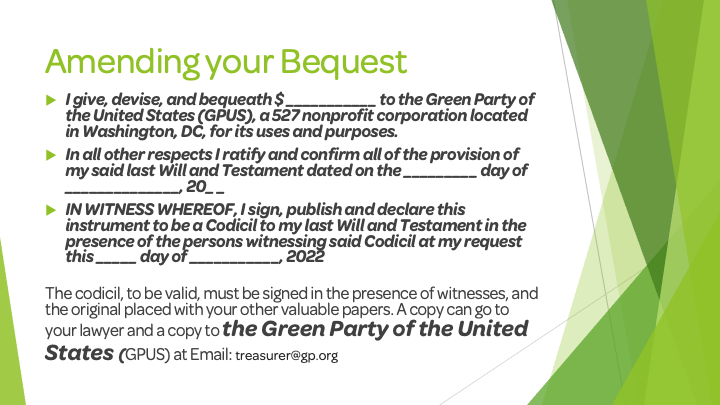

Can I amend my will without re-doing the entire document?

A simple amendment to a will is called a ‘codicil,’ which avoids the cost, and complication of re-writing an entire will. The codicil must be signed and witnessed or notarized as is the original will.

When do I need to change my will?

Your life circumstances are likely to change over time in one way or another, and you should be sure to get your will amended or even rewritten as these changes occur. Here are some common life events that may necessitate a change in your will:

- Change in marital status due to marriage, divorce or loss of a spouse

- A new baby or step-children

- Heirs named in your will pass away

- You move from a common-law property state to a community-law property state or vice versa

- You buy or sell significant assets

- You change your mind about your bequests to heirs

- You wish to add or change a charitable beneficiary

What is the role of an executor or personal representative?

An executor or personal representative is the person you assign the responsibility to manage and distribute your estate in accordance with your will. Most people will name their spouse or an adult child, or some other close heir , relative or friend. A good executor will be honest, organized, and possess good common sense. If possible, name someone who lives nearby and who is familiar with your financial matters. That will make it easier to do chores like collecting mail, selling assets, and finding important records and papers.

An executor’s work will be monitored by the Probate Court. An executor does not need to be an expert in finances, probate, law or taxes. They can and should hire any experts that are needed to assist them.

What is the Probate Court?

If there is no valid will, then the Probate Court will appoint an administrator of the estate to facilitate the estate’s distribution in accordance with state law. Where there is a will, the court determines the validity of a will and provides judicial oversight over the distribution of the estate.

What are my non-probate assets?

Non-probate assets are any assets in your estate that will pass to heirs outside of the Probate Court. Examples include jointly held property such as real estate or jointly held bank accounts; and assets that will pass to pre-stated heirs based on a death benefit beneficiary designation in a life insurance policy or qualified retirement plan (such as an IRA).

Additionally, some people title all their property to a living trust, and at death, the named trustee will distribute or manage assets in accordance with the trust document. The trust and assets possessed by the trust are not reviewed by the Probate Court. In states where probate fees are expensive, a living trust can save on those costs. Also, those who own property in another state may want to consider a living trust so that they do not have to deal with two (or more) Probate Courts.

Types of Gifts

Bequests

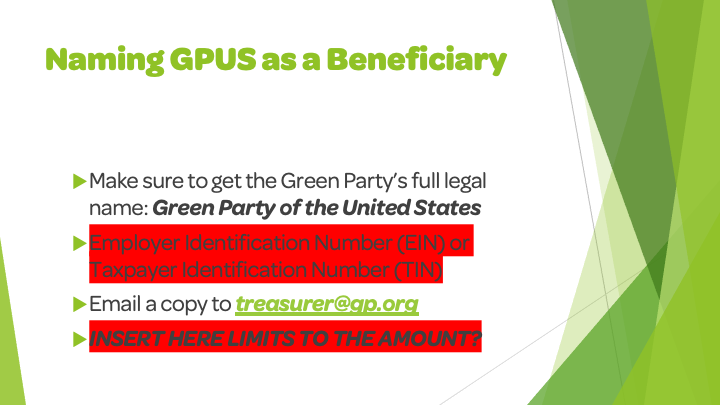

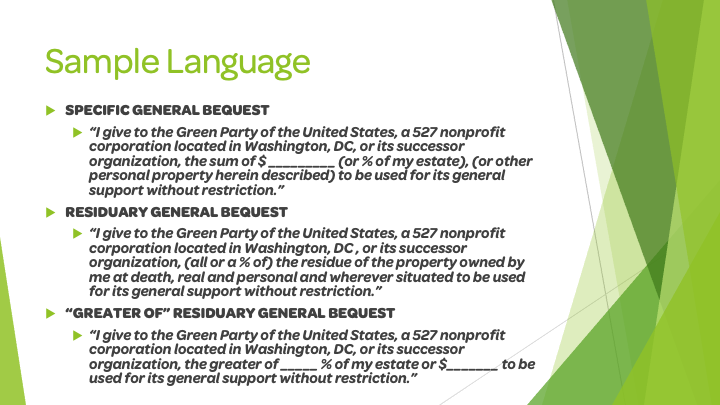

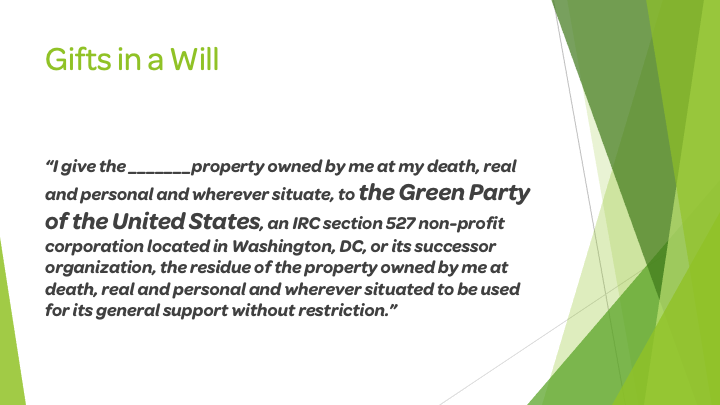

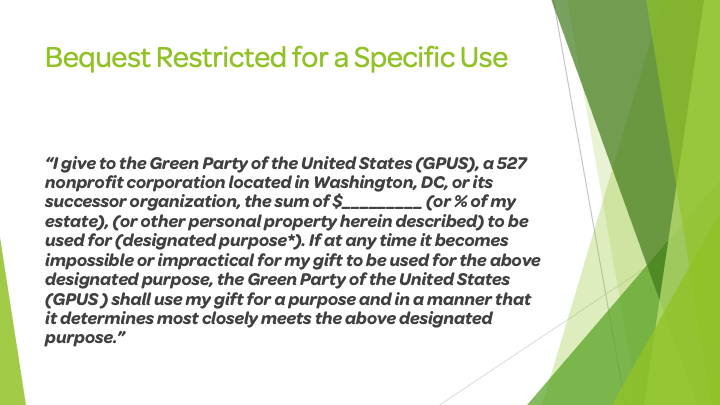

You can provide now for a future gift to the Green Party by including a bequest provision in your will or revocable trust.

Benefits

- Your assets remain in your control during your lifetime.

- You can modify your bequest if your circumstances change.

- You can direct your bequest to a particular purpose (be sure to check with us to make sure your gift can be used as intended).

Charitable Remainder Annuity Trusts

You transfer cash, securities or other appreciated property into a trust. The trust makes fixed annual payments to you or to beneficiaries you name. When the trust terminates, the remainder passes to the Green Party.

Benefits

- You or your designated income beneficiaries receive stable, predictable income for life or a term of years.

- You have the satisfaction of making a significant gift that benefits you now and the Green Party later.

Retirement Assets

You name the Green Party as the beneficiary of your IRA, 401(k) or other qualified plan. After your lifetime, the residue of your plan passes to the Green Party.

Benefits

- You can continue to take withdrawals during your lifetime.

- You can change the beneficiary if your circumstances change.

Making a charitable gift from your retirement plan is easy and should not cost you any attorney fees. Simply request a change of beneficiary form from your plan administrator. When you are done, please return the form to your plan administrator and notify the Green Party. We can also assist you with the proper language for your beneficiary designation.

Life Insurance

You name the Green Party owner and beneficiary of a policy insuring your life. You make annual gifts to the Green Party in the amount of our premium payments. When the policy matures the proceeds are paid to the Green Party, and we apply them to the program you have designated.

Stock and Appreciated Assets

It is important that you contact us so that we can assist you with transfer instructions. If you own securities in a brokerage account, we can help you set up an electronic transfer of the shares to our brokerage account. If you possess actual stock certificates, we can tell you how to sign the certificates over to us and fill out a stock power form. It is generally our policy to liquidate any donated stock shares very soon after receiving them, so that we can use the cash proceeds for the purpose you designate.